Choosing the right option and/or bundle of services for your practice is critical to help you achieve the goals you have as a practice.

When it comes to credit card processing rates, your options can be a little overwhelming and difficult to understand. There are a myriad of pricing models. The models that Worldpay and Henry Schein One focus on are very straightforward with as little cost variability as possible. They include Interchange Plus, Bundled, Tiered, and Flat-Rate All-Inclusive. While you are tasked with deciding which one is right for you, Henry Schein One can help.

There is a lot to consider in rates, fees, add-on services, and tools to assist with your practice’s PCI requirements, tokenization, fraud insurance and many other options in the terms of a merchant service contract. Choosing the right option and/or bundle of services for your practice is critical to help you achieve the goals you have as a practice.

Because there is a lot to think about, this article highlights one pricing model that is growing in popularity due to the peace of mind of cost containment — the Flat-Rate All-Inclusive model which fixes your costs for the life of your merchant services contract.

What is the Flat-Rate All-Inclusive Model?

The Flat-Rate All-Inclusive pricing model is an attractive option for many practices. One of the most frustrating parts for any business in accepting credit card payments is going through your monthly statement(s) and figuring out your exact and actual costs. There can be a multitude of fees attached to not only the transactions but from PCI to tokenization and everything in between. In the end, it is important to include all fees from all sources that support the processing of your patient credit cards so that you can calculate what is known as your ‘effective’ rate. The effective rate is your true cost of processing patient credit cards.

In the case of the Flat-Rate All-Inclusive model, Worldpay, in partnership with Henry Schein One, has worked to not only simplify the decision making process but to keep your costs contained for as long as you transact under the original merchant contract. When everything is added together, you not only have fixed effective rate costs but your practice is better protected with the latest in PCI, tokenization, transaction security, fraud insurance and other services that are constantly being updated to the latest standards. You can replace your frustration with credit card statements, increasing costs and protecting your business from credit card fraud with peace of mind. Worldpay and Henry Schein One are here as your trusted and fully integrated patient credit card payment partner every step of the way.

What is Included in the Flat-Rate All-Inclusive Pricing Model?

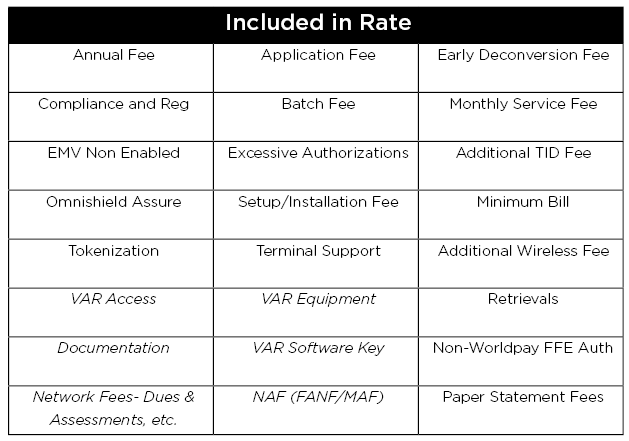

Below a list of all the items that are included with the Flat-Rate All-Inclusive model. Each merchant service provider might call these fees or services something different or have different items they charge for and/or have as additive services and costs. Depending on what merchant service providers include or do not include in their base rate and/or fees can cause drastic cost swings month to month or year to year. Merchant service providers have a myriad of ways to cover their costs as many of the fees and services are passed through from brands like Visa and/or the issuers of the cards. For your practice, the more straightforward the pricing model, the better.

Average Flat-Rate All-Inclusive Fees

From a purely transactional volume perspective, flat-rate fees are currently between 2.9 percent to 3.2 percent plus a per-transaction fee of between $.30 and $.45 based on historical and projected monthly volume. The nice thing about the Flat-Rate All-Inclusive model is that your fees will never change for the life of the merchant service agreement (even upon renewal). The fees cover the actual transaction fees and all other fees associated with any and/or all of the items listed in the table above.

The Flat-Rate All-Inclusive model makes calculating your fees predictable. Based on industry averages, those practices that go with one of Henry Schein One’s payment solutions will find that they are paying a lower effective rate across any of the offered pricing models.

The other three pricing models offered by Worldpay in partnership with Henry Schein One, on a variable month basis may have slightly higher or lower effective rate costs compared to Flat-Rate All-Inclusive pricing. This is all due to the types of cards patients use and if they are paying online or in-person.

Simplify Your Payments with One Easy Price

As patient payment preferences increasingly move to in-person and online payments using their credit or debit card, understanding the cost associated with offering these payment conveniences can become complicated. Reading through and deciphering a processing statement that includes a variety of fees can quickly become a drain on resources. Wouldn’t it be nice if you paid the same amount for each transaction?

Flat-Rate All-Inclusive pricing simplifies the complexities of payment processing with a single, clear rate for your transactions. What does this mean for your practice? With flat rate pricing, you can accept most popular payment types with one easy rate that’s right for your practice.

Plus, Flat-Rate All-Inclusive pricing:

- Eliminates the confusion around payment processing fees

- Gives you more predictable pricing to help with budgeting

- Streamlines your billing with costs all rolled into the per-transaction rate

- Provides clearer and easier to read monthly online statements

We know your practice is unique. The Product Sales Specialists at Henry Schein One can help you determine which pricing model is best for you now and in the future. Call 800.336.8749 or visit online today to talk to a payment expert.

Learn More

For more information about integrated payments, read our previous articles titled, Five Myths of Payment Processing Debunked and Processing Voids and Refunds with Dentrix Pay.

To speak to a payment expert about which pricing model is best for you, call 800.336.8749 or visit online today to talk to a payment expert.