Ensuring you have the most accurate information possible entered into the coverage table, you can feel confident that you are providing your patients with the most accurate estimates.

When it comes to calculating patient estimates, Dentrix can only calculate accurately if your team is entering insurance coverage information properly.

The first place Dentrix will look to calculate insurance estimates (and patient portions) is the payment table. The payment table defines the dollar amount an insurance plan pays for a specific procedure code. You can make entries in the payment table in the Dental Insurance Benefits and Coverage window or update it when you post insurance payments.

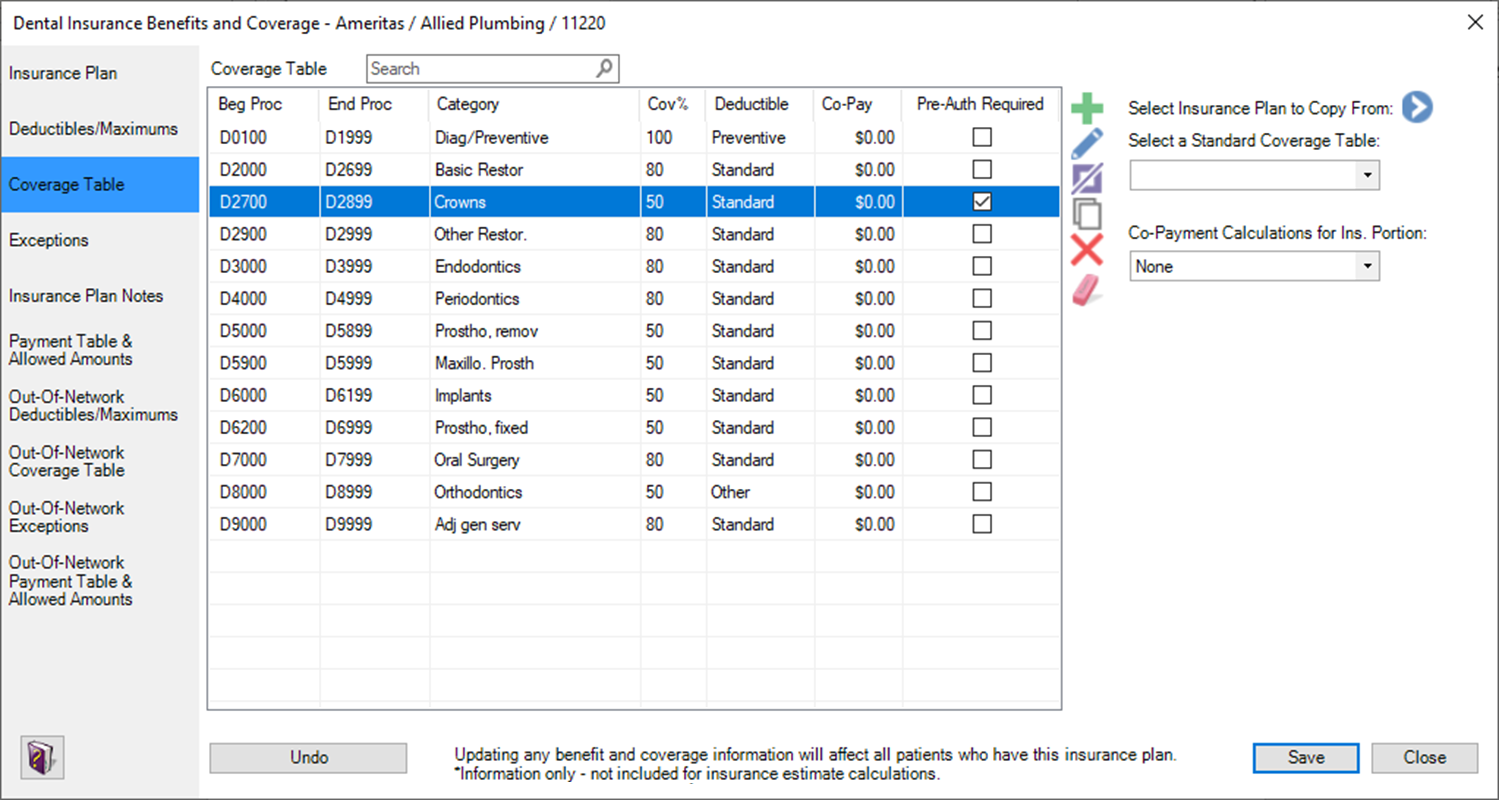

If the information isn’t found in the payment table, the next place Dentrix will look to calculate estimates is the insurance plan’s coverage table. In the coverage table, you can enter the percentages that an insurance company will pay for procedure codes and whether a deductible should be applied. You can also enter any co-pay a procedure may have and if a procedure requires a pre-authorization.

The coverage table is often underutilized because offices don’t know it can be customized in Dentrix based on the insurance trends you see in your office. The more detailed information you enter, the more accurate your patient estimates will be.

You can customize the default coverage table to be more detailed, which allows you to enter additional information. For example, by default, the Diagnostic and Preventive category (procedure codes D0100-D1999) may contain several procedure codes that may not be covered at 100%, like the rest of the category. I’ve found that many insurance companies are considering sealants (procedure code D1351) FMX (procedure code D0210), and PAs (procedure code D0220), to be categorized as Basic procedures, which are paid at 80% with a deductible applied.

You can separate these codes from the rest of the category and enter that information into the coverage table. In Dentrix G7.4 and later versions, a feature was introduced which splits a coverage table line into three separate lines. This feature makes customizing the coverage table a much easier process. Also, if you are missing procedure codes or if procedure codes are not sequential, Dentrix will indicate the line in red, so you know there is an error. This is important so that no procedure codes are missing from the coverage table.

You can customize the coverage table for individual insurance plans, but I prefer to customize the default coverage table in the Office Manager and enter the typical coverage that I see with most insurance plans. This gives you a good starting point, and then you can adjust the coverage for a particular plan as needed.

Remember, if there isn’t a payment table entry for a procedure code, Dentrix looks to the coverage table to calculate estimates. By ensuring you have the most accurate information possible entered into the coverage table, you can feel confident that you are providing your patients with the most accurate estimates. And accurate estimates are important because they allow you to collect at the time of service and maintain healthy cash flow for your practice.

Learn More

For additional information, see the following :

- Splitting Coverage Table Categories

- The Payment Table—Your Key to Accurate Insurance Estimates

- Improve Insurance Payment Estimates with Coverage Table and Payment Tables

By Charlotte Skaggs

Certified Dentrix Trainer and The Dentrix Office Manager columnist

Charlotte Skaggs is the founder of Vector Dental Consulting LLC, a practice management firm focused on taking offices to the next level. Charlotte co-owned and managed a successful dental practice with her husband for 17 years. She has a unique approach to consulting based on the perspective of a practice owner. Charlotte has been using Dentrix for over 20 years and is a certified Dentrix trainer. Contact Charlotte at [email protected].