Three ways you can use Dentrix to determine which insurance contracts are most beneficial to your practice.

If your practice is an in-network provider with dental insurance plans, it’s critical to evaluate those insurance contracts on at least an annual basis to determine if they’re still beneficial for your office. You’ll want to evaluate things like, if the fee schedule is still reasonable for your office; how many patients does your office have with that insurance; how long does it take the insurance company to pay; and how well do they pay.

Evaluate Fee Schedules

First, evaluate the fee schedule. Are the fees still acceptable for your office? For example, if your lab expenses and cost of dental supplies have increased, it may not be feasible to continue to accept a low contracted fee for a crown. You can contact the insurance company to find out if your office is eligible to request a fee increase.

Look at Insured Patient Numbers

Next, determine how many patients in your practice have the insurance plan you’re evaluating. This is important because even if an insurance fee schedule is low, if you have lots of patients with that insurance and they’re generating production for your office, you may consider remaining in-network for that plan. You can generate the Insurance Carrier List in the Dentrix Office Manager to see how many patients are attached to each insurance plan, or you can view the information by insurance plan in eDex.

Use Dentrix Reports

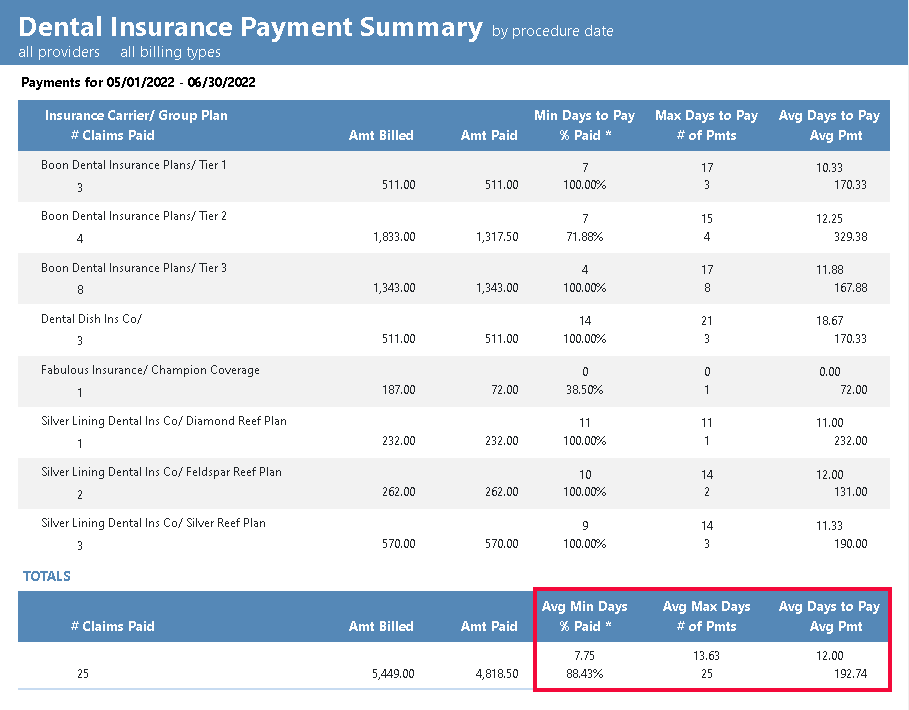

A great tool for evaluating insurance plans in your office is the Dental Insurance Payment Summary in the new Dentrix Reports module (available in Dentrix G7.8 and later). This report shows you the average number of days it takes an insurance plan to pay for claims. This information helps you to determine which plans are slow to pay and causing problems with your cash flow. Insurance plans that take longer to pay and also cost your office more in staff time, because someone on your team will probably need to check the status of the claim several times. Slower paying insurance companies may be ones that you consider terminating your contract with.

The Dental Insurance Payment Summary also shows you the percentage paid of what was billed to insurance, so you can get an idea of which insurance companies pay the best and which pay the worst.

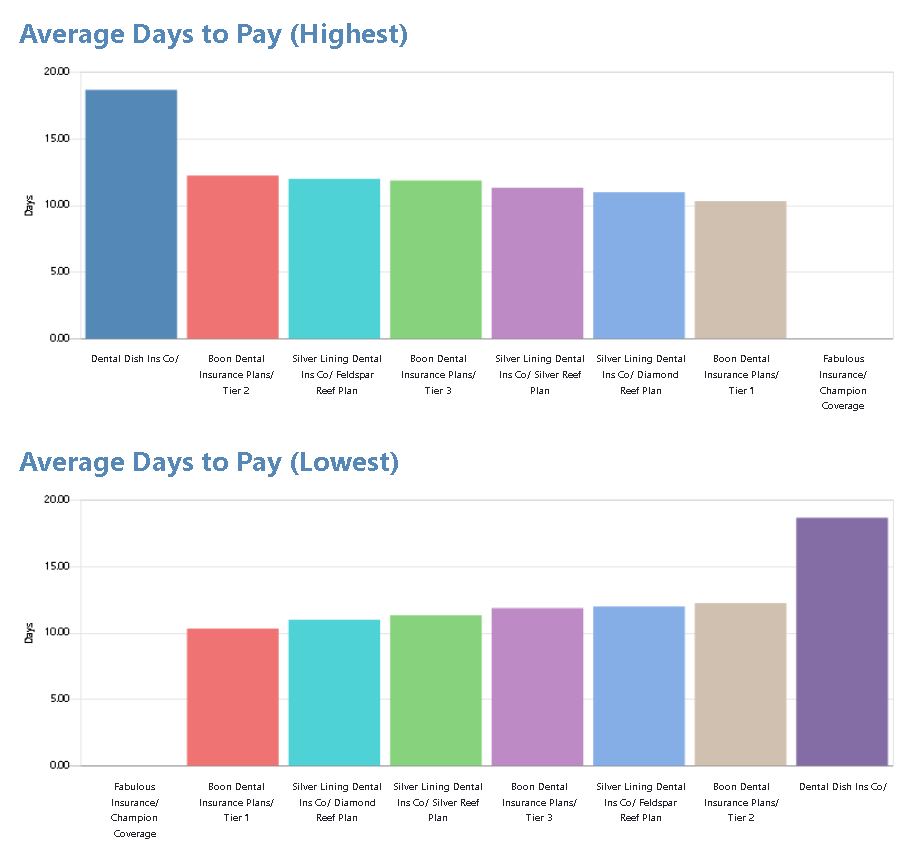

As with many of the new Dentrix G7.8 reports, the Dental Insurance Payment Summary can display the information in charts and graphs. What’s special about the charts and graphs for this report is that they display the top ten insurance companies with the highest average number of days to pay a claim and the ten insurance companies with the lowest average number of days to pay a claim.

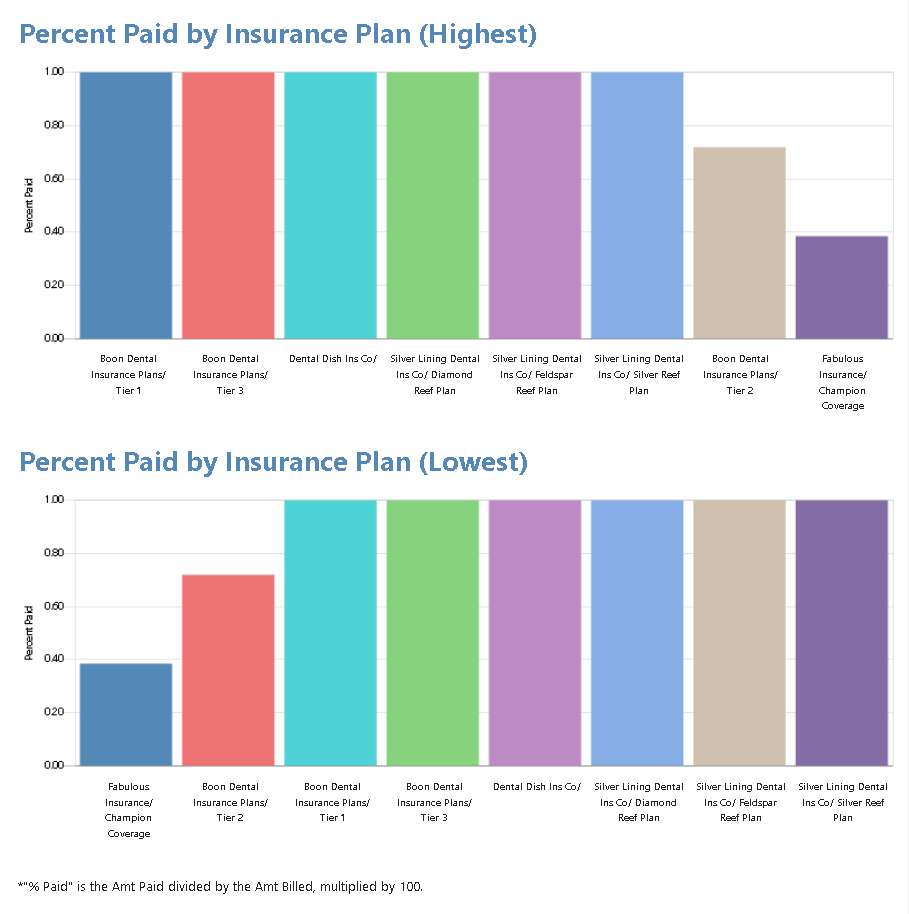

You’ll also see on the graphs the top ten insurance companies with the highest percent paid and the ten with the lowest percent paid. This makes it easy to see, when you’re considering terminating contracts with insurance companies that are no longer beneficial to your practice, which insurance companies pay the slowest and the least of what was billed.

Reviewing the fee schedules and contracts your office has with in-network insurance companies is something that should be done on a regular basis. You want to be sure that these contracts and the relationship with the insurance company is beneficial and lucrative for your practice. And the Dental Insurance Payment Summary in the new Dentrix Reports module can help you to easily evaluate that information.

Learn More

For additional information, read the following:

By Charlotte Skaggs

Certified Dentrix Trainer and The Dentrix Office Manager columnist

Charlotte Skaggs is the founder of Vector Dental Consulting LLC, a practice management firm focused on taking offices to the next level. Charlotte co-owned and managed a successful dental practice with her husband for 17 years. She has a unique approach to consulting based on the perspective of a practice owner. Charlotte has been using Dentrix for over 20 years and is a certified Dentrix trainer. Contact Charlotte at [email protected].