Use these two key features in Dentrix to help you accurately calculate patient portions for procedures.

Previously, I wrote about customizing coverage tables in Dentrix and how you can use them to more accurately estimate patient out-of-pocket expenses. Here are some additional tools in Dentrix you can use to provide your patients with the most accurate estimate of what their insurance is expected to pay.

Keeping the Payment Table Updated

The Payment Table in Dentrix allows you to enter a dollar amount that an insurance company will pay for a particular procedure code. This can be very beneficial in the case of an alternate benefit, like when an insurance company provides an alternate benefit for a posterior composite filling.

When making changes to the Payment Table or the Coverage Table, it’s important to remember that changes made will affect all the patients covered under that insurance group plan. This can be a great tool because as you update the Payment Table for one patient, you can provide an even more accurate estimate for the next patient covered under that insurance plan that has the same procedure.

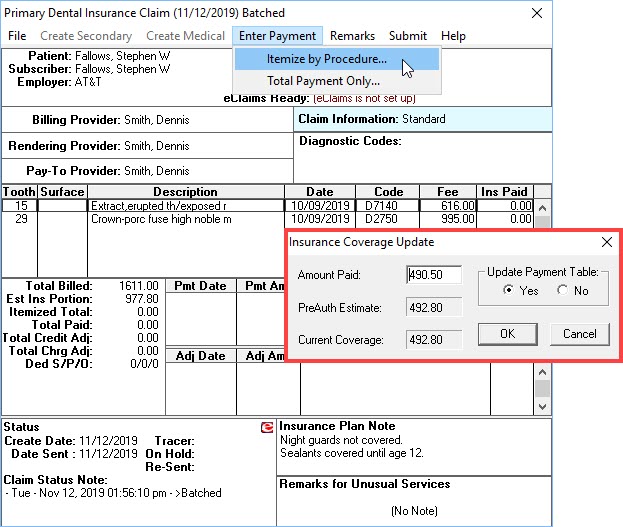

You can enter amounts into the Payment Table in the dental insurance portion of the Family File, but I find the most efficient way to enter these amounts is when posting an insurance payment, by clicking Enter Payment, and then selecting the Itemize by Procedure option.

Whether you post an insurance payment through an individual claim or if you use the Batch Dental Insurance Payment feature, you have the option to update the Payment Table.

The majority of the time, I recommend you update the payment table so Dentrix estimates insurance payments more accurately in the future for all patients with this dental insurance group plan. I would not recommend updating the payment table if a procedure:

- Wasn’t covered due to a patient’s frequency limitations

- Wasn’t covered due to the patient needing to meet their deductible

- Wasn’t covered due to an age limitation

- Was partially covered (or not covered) due to a patient meeting their annual insurance maximum

Keeping Track of Deductibles

Dentrix gives you an option to enter the amount a patient has used of their annual maximum, if they have met their deductible outside of your office. I find this to be a great tool, especially as we approach the end of the year when many patients may have used a significant portion of their annual maximum. If a patient has used some of their maximum at a specialty office, for example if you referred them to an endodontist for a root canal, it is important for Dentrix to calculate the amount of insurance used at the specialist’s office in the treatment plans you create in your office.

You can use these features in Dentrix to accurately calculate insurance and patient portions of procedures. Using the Payment Table, entering maximums and deductibles used, and customizing Coverage Tables can help you to provide your patients with the most accurate estimates. This can result in maintaining healthier accounts receivables by allowing you to collect accurately from patients at the time of service.

Learn More

For additional information, read the following :

- Improve the Accuracy of Patient Fee Estimates

- Improve Insurance Payment Estimates with Coverage Tables and Payment Tables

- Adding Procedures to Payment Tables

By Charlotte Skaggs

Certified Dentrix Trainer and The Dentrix Office Manager columnist

Charlotte Skaggs is the founder of Vector Dental Consulting LLC, a practice management firm focused on taking offices to the next level. Charlotte co-owned and managed a successful dental practice with her husband for 17 years. She has a unique approach to consulting based on the perspective of a practice owner. Charlotte has been using Dentrix for over 20 years and is a certified Dentrix trainer. Contact Charlotte at [email protected].