Maintaining current accounts receivable and collecting balances due from patients and insurance can be challenging for some practices, especially for those practices struggling with staffing shortages or a lack of collections policies and procedures.

I’ve found that one of the best ways to keep up with accounts receivables is to monitor Dentrix reports regularly to monitor the following:

- How much money is owed to the office.

- How much of the money falls into the current (0-30 days past due), 31-60 days past due, 61-90 days past due, and over 90 days past due.

Focusing on the aging of the account is critical because the older the account balance, the less likely the office is to collect that balance.

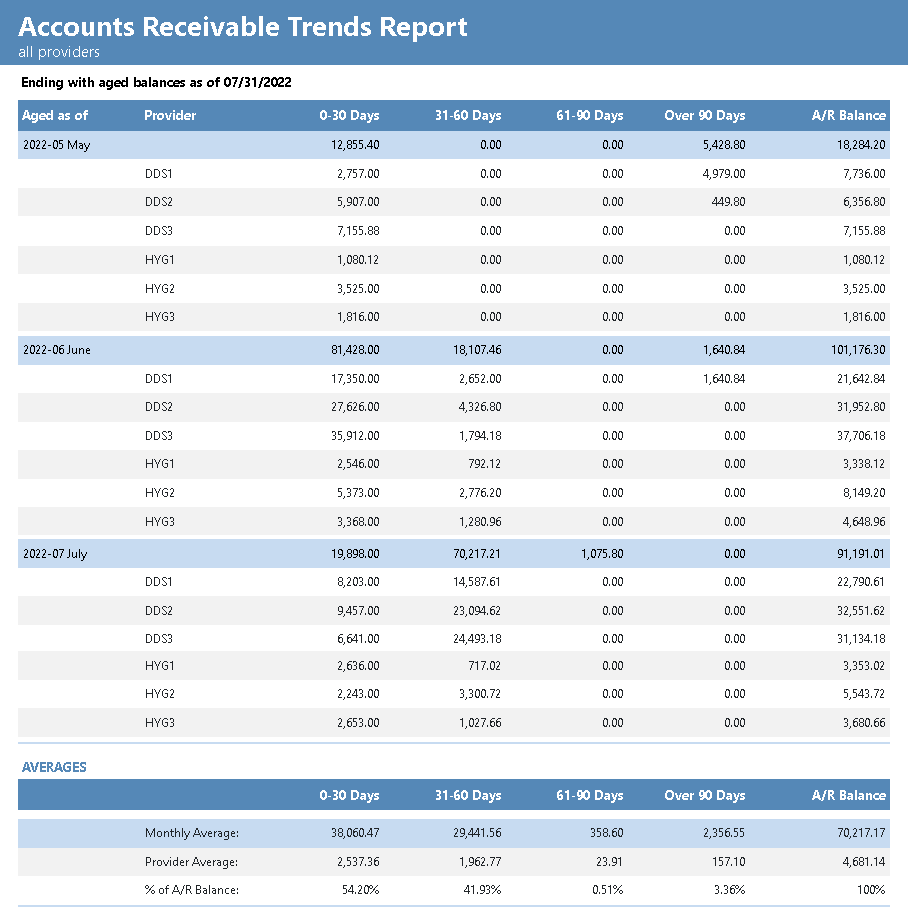

In Dentrix G7.8, new reports are available to help you analyze your Dentrix data. One of these reports is the Accounts Receivable Trends Report.

This report can help show historical data for accounts receivable in your office. You can see what the accounts receivable totals are for each month, broken down by provider. You can then use the information seen in the report to determine trends in your office.

For example, you may have months where collections may be more challenging because you can see an increase in accounts within the over 60 and over 90 days aging brackets.

Or, when you see a specific provider with a particularly high current accounts receivable for a month, that may be because that provider had a high production month and there were outstanding claims to be paid by insurance plans.

One of my favorite things about this new report is the bar graph and pie chart that you can include to visually represent the account aging and monitor your office accounts receivable throughout the aging process.

When you’re working to monitor your accounts receivables, you can focus on decreasing those accounts in the 31-60 days past due and older brackets. For greater details, you can use the Aging Report in the Dentrix Office Manager, or better yet, the Collections Manager to target specific accounts. You can use Collections Manager view to filter the types of accounts you want to concentrate on, and then have easy access to other areas of Dentrix like the Ledger and the Guarantor notes, all from within Collections Manager.

The goal for every practice should be to not allow accounts to become past due. You can evaluate your office’s processes to see if there are areas you where you can improve this goal.

For example, in your office do you always collect the patient portion at the time of service? Are you able to provide your patients with accurate treatment estimates based on the insurance information that your team has entered into Dentrix? Are you offering your patient’s convenient payment options to encourage them to pay?

By monitoring accounts receivable regularly, you can stay on top of accounts and handle any that are past due before they become a problem. You can re-evaluate your office policies and make any necessary changes to improve the collection process and maintain healthy accounts receivable.

Learn More

For more information on the new Accounts Receivable Trends Report and other new reports available in Dentrix G7.8, read Dentrix Reports—A New View of Your Practice Information.

Watch the webinar recording that features the Dentrix G7.8 Reports module.

By Charlotte Skaggs

Certified Dentrix Trainer and The Dentrix Office Manager columnist

Charlotte Skaggs is the founder of Vector Dental Consulting LLC, a practice management firm focused on taking offices to the next level. Charlotte co-owned and managed a successful dental practice with her husband for 17 years. She has a unique approach to consulting based on the perspective of a practice owner. Charlotte has been using Dentrix for over 20 years and is a certified Dentrix trainer. Contact Charlotte at [email protected].