Read about common scenarios that are leading to claim denials and what you can do to avoid that and get paid.

Updated 10/29/21

I don’t know about other areas of the country, but in my neck of the woods I’m hearing from offices that insurance companies are denying their claims in record numbers. Even in my own office, where we typically have only $1,500 to $3,000 in outstanding claims over 30 days, that number has climbed to more than $5,000. And there doesn’t seem to be any pattern to follow, where we could nip it in the bud with one quick fix. Instead, we as office managers and financial coordinators must troubleshoot the problems and fix them in order to collect insurance payments.

Let’s take a look at where some of the problems arise, and I will give you some suggestions on how to create a better insurance claim.

One problem I’m seeing is an increase in how often buildups are denied. In the past some doctors would place a buildup and not charge a patient for it. I think they felt they were giving patients good service by saving them some money. However, with insurance companies reducing our provider reimbursements significantly, it makes me wonder if the doctors are finally billing the buildup out to the insurance company to make up for this difference. In any case, a buildup requires a clinical narrative and in some cases an X-ray to justify the procedure.

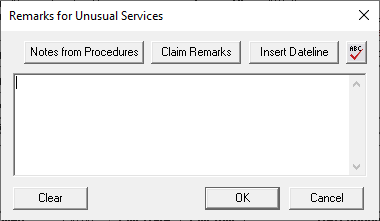

This narrative goes in the Remarks for Unusual Services box on the claim form. A good narrative should include description of the existing restoration, the current condition of that existing restoration, and the current disease of the tooth. For example — “Existing crown 10+ yrs old, ill fitting, recurrent decay, insufficient tooth structure to support new crown.”

There are also some specialty boxes within the claim that need to be filled out in some situations. From the Ledger, double-click the insurance claim and then double-click the Claim Information block. This will open the Insurance Claim Information window, where you can enter some pertinent information such as orthodontic banding dates, removable prosthetic information, pre-authorization numbers, and more.

Another problem I have seen lately is claims being denied because the address does not match in the Billing Provider box and the Treating Doctor box. If you are using two different providers in these two sections, make sure the addresses match. You can double check the addresses for your providers in the Office Manager. Click Maintenance > Practice Setup > Practice Resource Setup, and then select the provider and click the Edit button to see that provider’s address.

If we can fill out the claim completely the first time, then we can hopefully avoid the frustration of a denied claim in the future.

Learn More

For more ideas about collecting payment from insurance companies, read Follow Through for Successful Claims and Reduce Claim Denials and Delays with Automatic eClaims Attachments.

To learn more about narratives and additional claim information, read the Processing Insurance Claims Overview topic in Dentrix Help.

To learn more about provider setup, read Editing Provider Information in Dentrix Help.

By Dayna Johnson, Certified Dentrix Trainer

Dayna loves her work. She has over 25 years of experience in the dental industry, and she’s passionate about building efficient, consistent, and secure practice management systems. Dayna knows that your entire day revolves around your practice management software—the better you learn to use it, the more productive and stress-free your office will be. In 2016, Dayna founded Novonee ™, The Premier Dentrix Community, to help cultivate Dentrix super-users all over the country. Learn more from Dayna at www.novonee.com and contact Dayna at [email protected].