When deciding whether to drop an insurance plan, it’s important to review all relevant Dentrix reports so you can make an informed decision that’s best for your practice.

Many offices are considering dropping the PPO plans that they participate with. If that’s the case for your practice, there are reports in Dentrix that will help you to evaluate which plans are working the best for your office and which aren’t.

When considering if an insurance company is worthwhile to continue working with, consider the following things:

- How long does it take them to pay?

- Do they pay what your office is estimating?

Use Dentrix Reports to Evaluate PPO Plans

Insurance Payment Summary

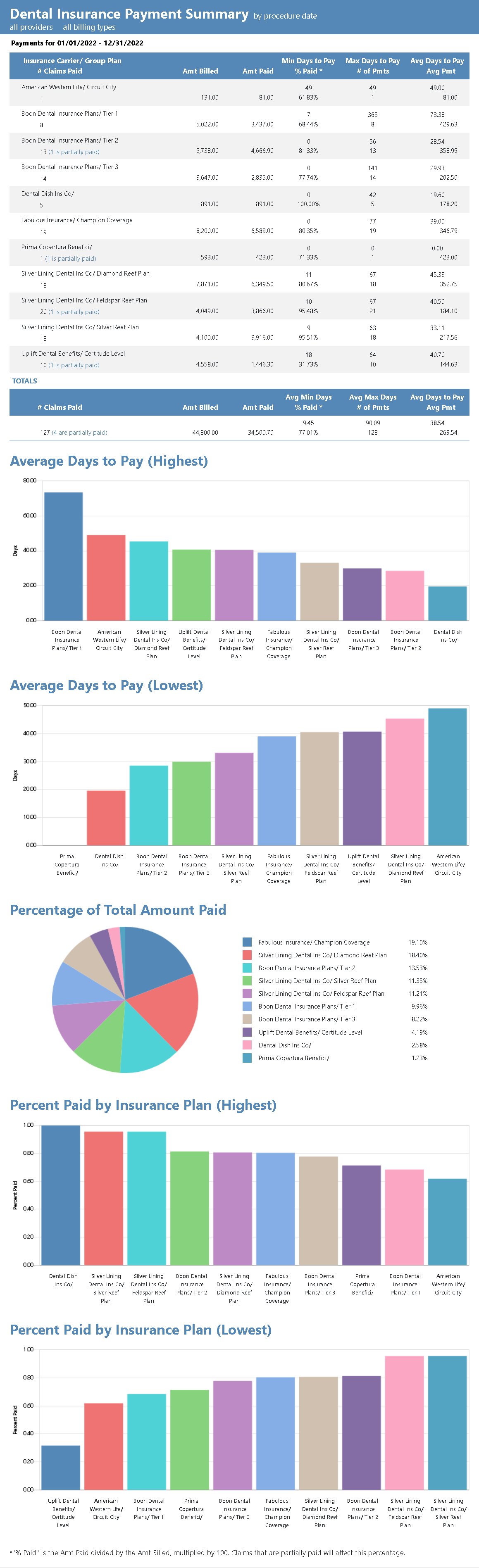

The Insurance Payment Summary allows you to see how long it takes for an insurance plan to pay on claims. On the report, you’ll see the minimum and maximum number of days it takes for each plan to pay and the average number of days. When using this report to evaluate the performance of an insurance plan, the average number of days it takes to pay is a good barometer. If an insurance plan is taking a long time to pay, it can increase your accounts receivable and negatively affect your cash flow.

You can include graphs when generating this report, which will allow you to easily view the ten insurance plans with the highest number of days to pay.

Once you’ve identified the slowest paying plans, you can reference the Insurance Transaction Report and see how much of what your office estimated to be paid was actually paid by the plan.

Insurance Transaction Analysis

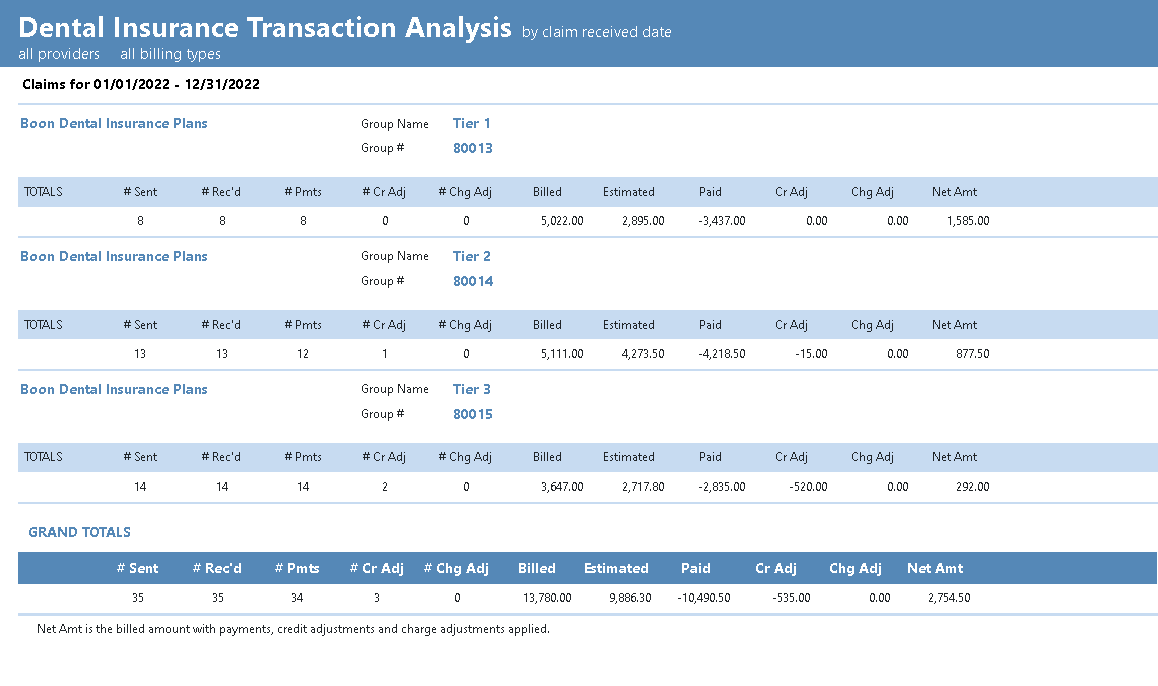

The Insurance Transaction Analysis allows you to see how much was billed, how much was estimated to be paid by the insurance plan, how much was actually paid, and subsequently what adjustments had to be made.

You can choose to include individual patient names and the procedures included on each claim, but in this case, to evaluate how well an insurance company is paying your office overall, I would suggest not itemizing claims. That way you can evaluate the overall performance of the insurance plan without having to view all the patient details.

When viewing the report, I suggest using a date range of the last twelve months so you can get a true picture of how much the insurance is paying and how many adjustments you have to make for that plan. If you use a shorter time period, only one month for example, and you only saw a single patient with that insurance plan, and the insurance plan did not pay what your office had estimated, then that individual claim would not provide you with accurate information in order to evaluate that insurance plan. Maybe the patient’s annual benefits were used, or they had a waiting period that your office was unaware of. Either way, it’s better to look at a longer time frame to get a better, more accurate picture.

Once you’ve used these Dentrix reports to determine which are the slowest paying and lowest paying insurance plans in your practice, you’ll want to see how many patients are attached to those plans. These are patients you may potentially lose by dropping their PPO plan. You can generate the Insurance Carrier List and include insured patients to find how many patients are on the plan and who they are. Once you have that information, consider which patients are on the list. Are they “good patients” that may hurt the practice to potentially lose? “Good patients” could mean various things depending on your practice:

- Do they visit the office regularly for their hygiene and exam appointments or do they only come in once every few years when they have a problem?

- Do they pay their bill in a timely manner?

- Do they frequently no-show or cancel appointments at the last minute?

Once you’ve considered all these factors, you can determine if your practice should consider dropping a PPO plan. You typically have to notify the insurance company in writing that you no longer want to be a contracted provider. They will then provide you with a date that your office will no longer be in network. Some insurance companies release you from the contract in sixty or ninety days, while others can take up to six months.

Contacting Patients about PPO Coverage Changes

After you have notified the insurance company, you’ll then need to inform your patients of this change and how it will affect them. It can be a delicate situation, and there’s a chance you may lose patients, but I believe the way a practice handles the situation can make or break whether a patient decides to stay with the office.

I believe that it all begins at the very beginning of the practice-patient relationship. Clearly explain to your patients how dental insurance PPOs work. Unless they are in the dental field or dental insurance industry, they are unlikely to have an understanding of the way dental insurance claims are considered and paid. Many patients believe they just have to pay their copay, as they do with their medical provider.

In the information that new patients fill out, you can include information regarding dental insurance PPOs. Explain to them that they have a maximum amount that the insurance will pay per calendar year or plan year. Explain that their insurance covers a percentage towards each procedure, and if you are not an in-network provider with the plan, it will be a percentage of what the insurance considers to be usual and customary, which never represents a true average fee for the procedure.

When discussing a treatment plan with a patient, always explain that projected costs are only an estimate, and your office cannot guarantee what will be paid by their insurance. I recommend offices use this type of disclaimer as a case note on treatment plans to remind patients of this information.

Since you have already properly educated your patients about their insurance throughout their relationship with your practice, if your office decides to drop their PPO plan and become an out-of-network provider, they should already have an idea of what that will mean.

You should also write a letter to your patients informing them that your office will no longer be in-network for their insurance plan. Explain to them why your office will no longer participate with their plan. For example, you could say something like, “Despite multiple requests to increase fees based on industry standards, we have been unable to come to an agreement.” Let your patients know the date that this change will take effect. Advise them your office will be happy to verify their out-of-network benefits and provide them with an estimate for any outstanding treatment.

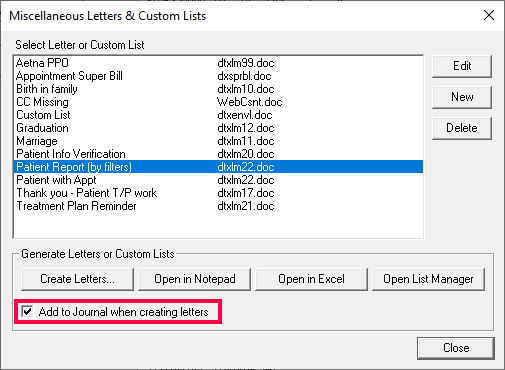

To make this process easier and less time consuming, you can create a letter template and use a custom report to send letters to patients with the insurance plan your office is planning to drop. I suggest selecting the Add to Journal when creating letters option, so you have a record of when you sent the letter and which patients it was sent to.

While you may have some patients that react negatively to this information and decide to go to another practice, hopefully your work educating patients about insurance will pay off and they will understand that although your office will no longer be in-network with their plan, they are able to remain patients at your office.

If your practice has been providing them with high quality patient care, in my experience, even if they do leave your practice, some patients will return even though your office is no longer in-network with their plan because they appreciate the quality of care they received.

Conclusion

When thinking about dropping an insurance plan, it’s important to review all relevant Dentrix reports first so that you can make an informed decision that’s best for your practice. Then take the time to notify those patients that will be impacted by the change.

Learn More

For additional information see these resources:

By Charlotte Skaggs

Certified Dentrix Trainer and The Dentrix Office Manager columnist

Charlotte Skaggs is the founder of Vector Dental Consulting LLC, a practice management firm focused on taking offices to the next level. Charlotte co-owned and managed a successful dental practice with her husband for 17 years. She has a unique approach to consulting based on the perspective of a practice owner. Charlotte has been using Dentrix for over 20 years and is a certified Dentrix trainer. Contact Charlotte at [email protected].