Learn about recent insurance features added to Dentrix and how they will help make insurance management easier in your practice.

One of my favorite new features is the Insurance Benefits and Coverage window available in Dentrix G7.4 and higher). I wanted to share with you what some of these new features are, and why I think they are going to make things so much easier in your office.

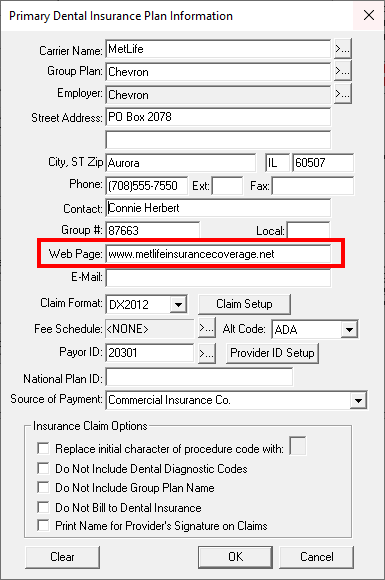

Enter Insurance Company Web Page

First, there’s a new option to enter a web page for the insurance company. Double-click a patient’s Insurance block in the Family File to open the Insurance Information window, and click the Insurance Data button.

The reason I really like this option is because I often find myself going on the insurance website to verify coverage or check the status of a claim. By having the web page address entered and saved as part of the Primary (or Secondary) Insurance Plan Information, I don’t have to look somewhere else for it.

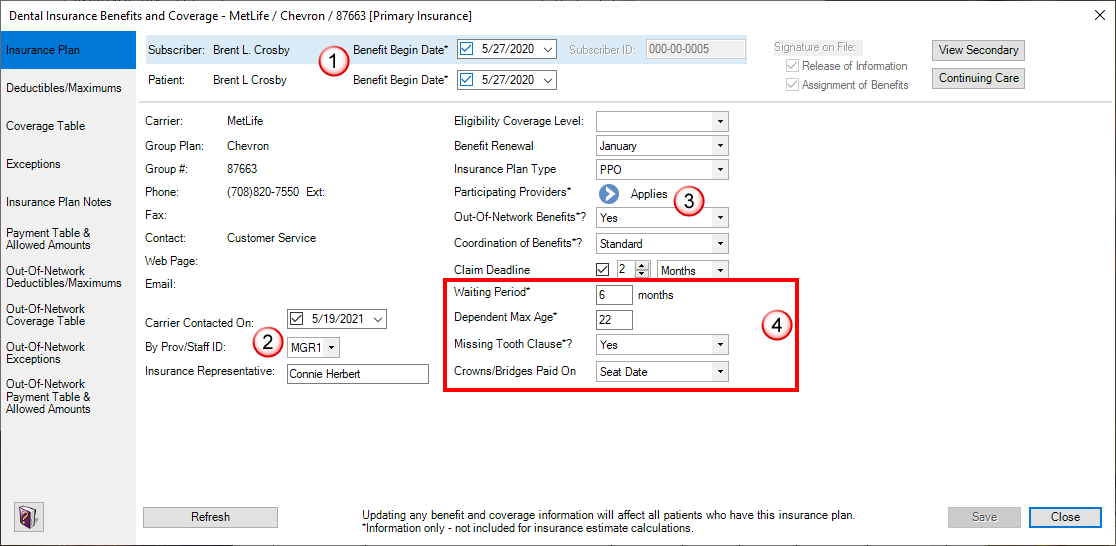

Insurance Plan Data

Next, there’s the Insurance Plan tab within the Dental Insurance Benefits and Coverage window that provides you with specific, dedicated places to enter lots of important insurance information.

1- You can enter the date that benefits begin for both the subscriber and the patient. The reason this information is important is because it will help you to know when any applicable waiting periods have been met.

2- There is a field to enter when the carrier was last contacted and who in your office contacted the carrier. This is important because if you notice the last update was three years ago, you’re definitely going to want to re-check the insurance benefits and update them in Dentrix. It’s also helpful to know who in your office contacted the carrier. Sometimes you may have a team member that finds entering and understanding insurance to be challenging. If that team member updated the insurance plan, you may want to double-check her work to see if she needs some more training.

3- You can now make note where the insurance plan has out-of-network benefits, and which providers in your office are participating and non-participating with the insurance plan. I really like this new feature for offices with more than one doctor, when one doctor is participating, and one is non-participating. In a practice I worked with recently, the father and son are both doctors in the same office. The father is on his way to retiring and working less hours. He doesn’t want to participate with any insurance plans. However, the son is just beginning to build his practice and so he’s signed contracts with several insurance plans. The option to enter in- and out-of-network benefits would be a great new feature for this office because Dentrix will now have the ability to calculate patient estimates correctly for both doctors.

4- New appointment-related details are going to make a huge difference in your day-to-day workflow. You now have the option to enter whether there’s a waiting period, if there’s a maximum age for dependents, if there’s a missing tooth clause, and if crowns and bridges are paid on prep date or seat date. Although these details won’t be factored into estimates, a new and exciting warning system will help you to avoid scheduling appointments that conflict with the plan details. For example, if you’ve entered that an insurance carrier has a missing tooth clause and you try to schedule a bridge appointment for a patient who has this insurance, Dentrix displays a warning right in the Appointment Book, to alert you to the insurance plan details. I’m sure we can all think of dozens of times during our dental careers that this new feature would have been such a huge benefit! I think this will make a huge difference to our work lives on a daily basis!

Being able to enter an insurance carrier’s web page will save you time instead of having to look for it outside of Dentrix.

The information found under the Insurance Plan tab in the Dental Insurance Benefits and Coverage window provide you with a dedicated place to enter important plan information. The ability to enter non-participating benefits will be especially helpful for multi-doctor practices. And the new appointment warnings are going to make a huge difference when scheduling patients’ appointments.

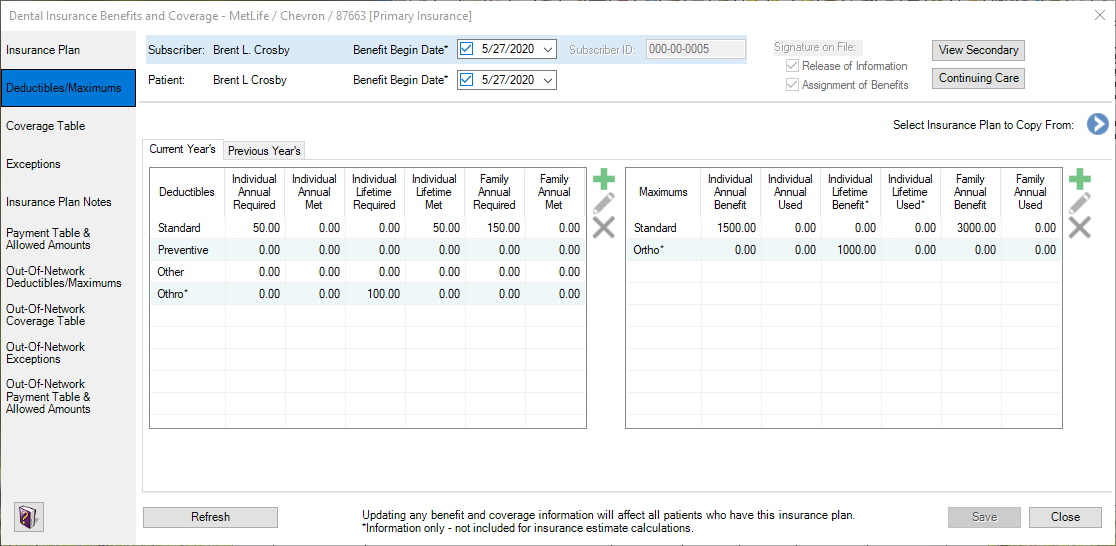

Maximums and Deductibles

In Dentrix, there has always been a place to enter in patients’ maximums and deductibles. However, you’ve never had the option to customize that information, until now.

Insurance plans are constantly changing the way they consider patients’ benefits. There are plans that now consider different procedure categories under different maximums. For example, an insurance plan may have no maximum for diagnostic and preventative procedures, but will have a maximum for basic and major procedures.

A patient could have insurance coverage that has a separate orthodontic maximum that’s not considered part of their general calendar year maximum. Plus, there could also be a separate orthodontic deductible.

Now you have a designated place to enter that information. And best of all, you can track the maximum used and deductible met. It’s important to note that this information won’t be factored into estimates in Dentrix, and you will still need to manually enter the amounts used. And the Deductibles/Maximums window is the place to do that.

For example, let’s say a patient has a standard annual deductible of $50, and an annual maximum of $1500. They also have a lifetime orthodontic deductible of $100 and a lifetime orthodontic maximum of $1000. It’s so exciting to now have a dedicated place to enter this information and track how much has been used. Now, when your patient comes in for a prophy and exam, fillings, and/or clear aligner, you can track those maximums used accurately. Before this new feature, offices found creative ways to track this information in places like the guarantor notes, patient notes, or insurance claim status notes, which wasn’t ideal or consistent from staff member to staff member. Now you have a single place to document that information that’s very easy to use.

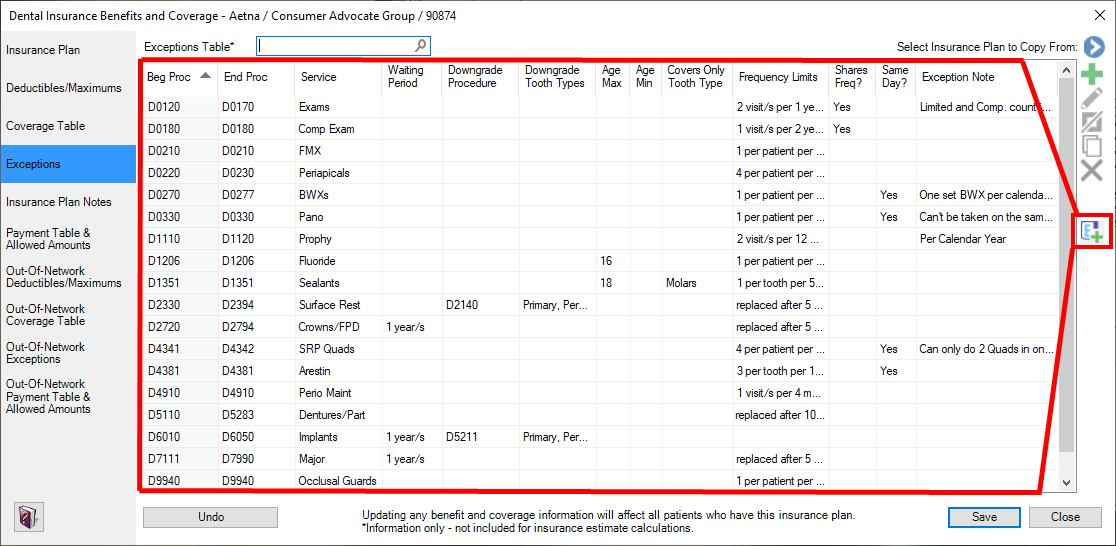

Exceptions Table

You can also document detailed plan information like frequency limitations and age limitations in the Exceptions window. I love this new feature because I always used to suggest to offices that they enter this type of information into the Insurance Plan Notes. I recommended doing that instead of simply referring to an insurance breakdown in the Document Center, because Insurance Plan Notes apply to all patients covered under that plan, so you wouldn’t have to type those notes again if it’s an existing plan in your system. The Exceptions window has made huge improvements to that process.

Here are three of my favorite things about the new Expectations window.

- You no longer have to type long sentences. There’s an easy-to-use menu to allow you to select applicable plan details, like tooth limitations (primary, permanent, anterior, posterior), age limitations, frequency limitations, downgrades, and waiting periods.

- Exceptions apply to all patients covered under that plan, so once you’ve entered the information for the plan, you’re good to go!

- By clicking the Insert Exceptions Template button on the right side of the Exceptions window you can quickly import a template that is pre-populated with common procedures and plan details that you can easily customize.

Team members responsible for entering exceptions in to Dentrix can simply work their way through this template and enter plan details. No more excuses for forgetting to enter the information. I’ve had a situation where the hygienist wanted to do scaling and root planing for a patient in the office, but the administrative team hadn’t entered in the information pertaining to how often the procedure could be performed, or how many quadrants could be done in a day. This promptly brought the day to a halt while the hygienist had to wait while the front desk contacted the insurance company in order to provide the patient with an accurate estimate. By using the Exceptions Template, things can’t be missed.

The features in the Dental Insurance Benefits and Coverage are so exciting because they not only help you track customized deductibles and maximums, but they also allow you to enter customized exceptions details in a designated place in Dentrix. By using these features, you can provide patients with more accurate estimates with less time contacting insurance companies because you’ll have all the information you need in one place.

Learn More

For additional information, visit the What’s New Blog to keep up with the latest features and releases in Dentrix.

By Charlotte Skaggs

Certified Dentrix Trainer and The Dentrix Office Manager columnist

Charlotte Skaggs is the founder of Vector Dental Consulting LLC, a practice management firm focused on taking offices to the next level. Charlotte co-owned and managed a successful dental practice with her husband for 17 years. She has a unique approach to consulting based on the perspective of a practice owner. Charlotte has been using Dentrix for over 20 years and is a certified Dentrix trainer. Contact Charlotte at [email protected].