Use the Dental Insurance Benefits and Coverage window to record important exclusions and other insurance notes for each plan stored in Dentrix.

A patient’s dental insurance is ultimately their responsibility. However, we at the dental office often assume some of the responsibility of keeping up with the patient’s insurance because it benefits us in the long run. If you are able to accurately estimate what an insurance plan will pay, you can collect the patient portion at the time of service, avoid future payment problems, and consequently maintain a healthy accounts receivable.

As an office manager, I try to keep up to date with a patient’s insurance benefits, such as frequency limitations and any special coverage clauses. This is important because it goes a long way in helping the patient avoid an unexpected balance.

Take this situation, where knowing a patient’s benefits would be important, for example:

A patient has a bridge placed, but there was a missing tooth exclusion in their insurance coverage, their insurance denies the claim, and they end up with a large unexpected balance. This is not only upsetting for the patient, but it can be costly for your office as well. This balance may remain unpaid for a long time, or the patient may need to make payments on the procedure, which affects the office accounts receivable and accounts aging.

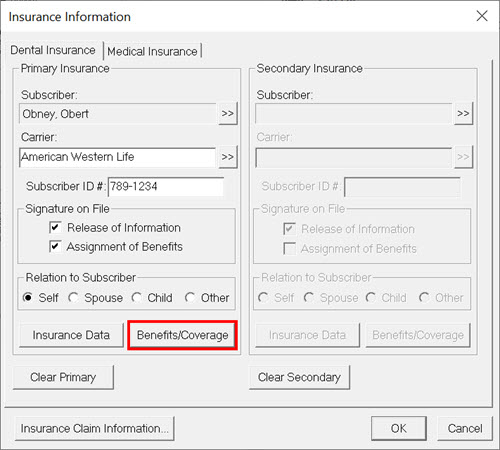

Insurance plan exclusions and frequency limitations can be documented in Dentrix. In the Family File, double-click the Insurance block, and then click the Benefits/Coverage button.

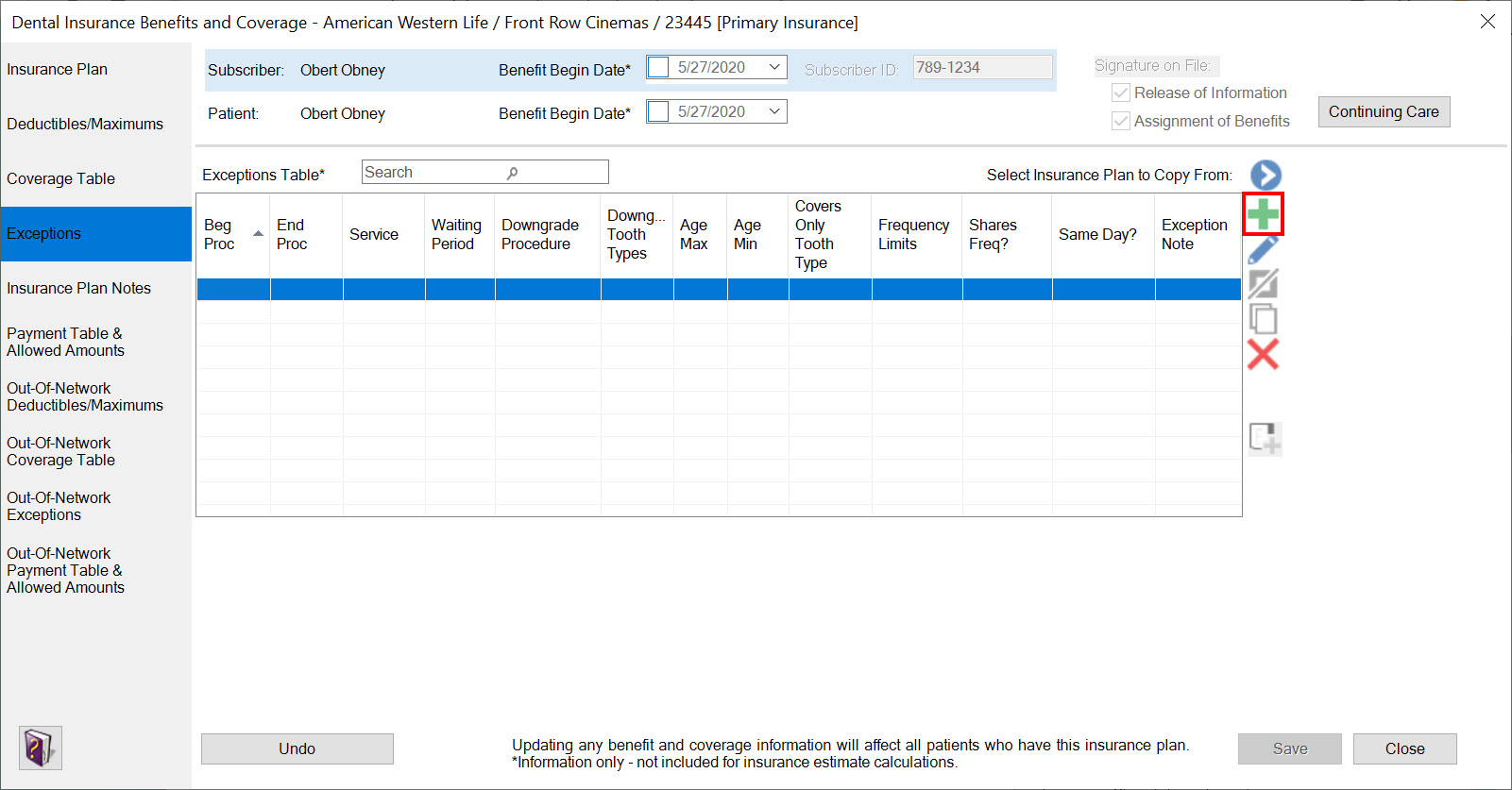

This opens the Dental Insurance Benefits and Coverage window. You can enter any exceptions by clicking the Exceptions tab, and then clicking the green + to enter individual exceptions to their plan.

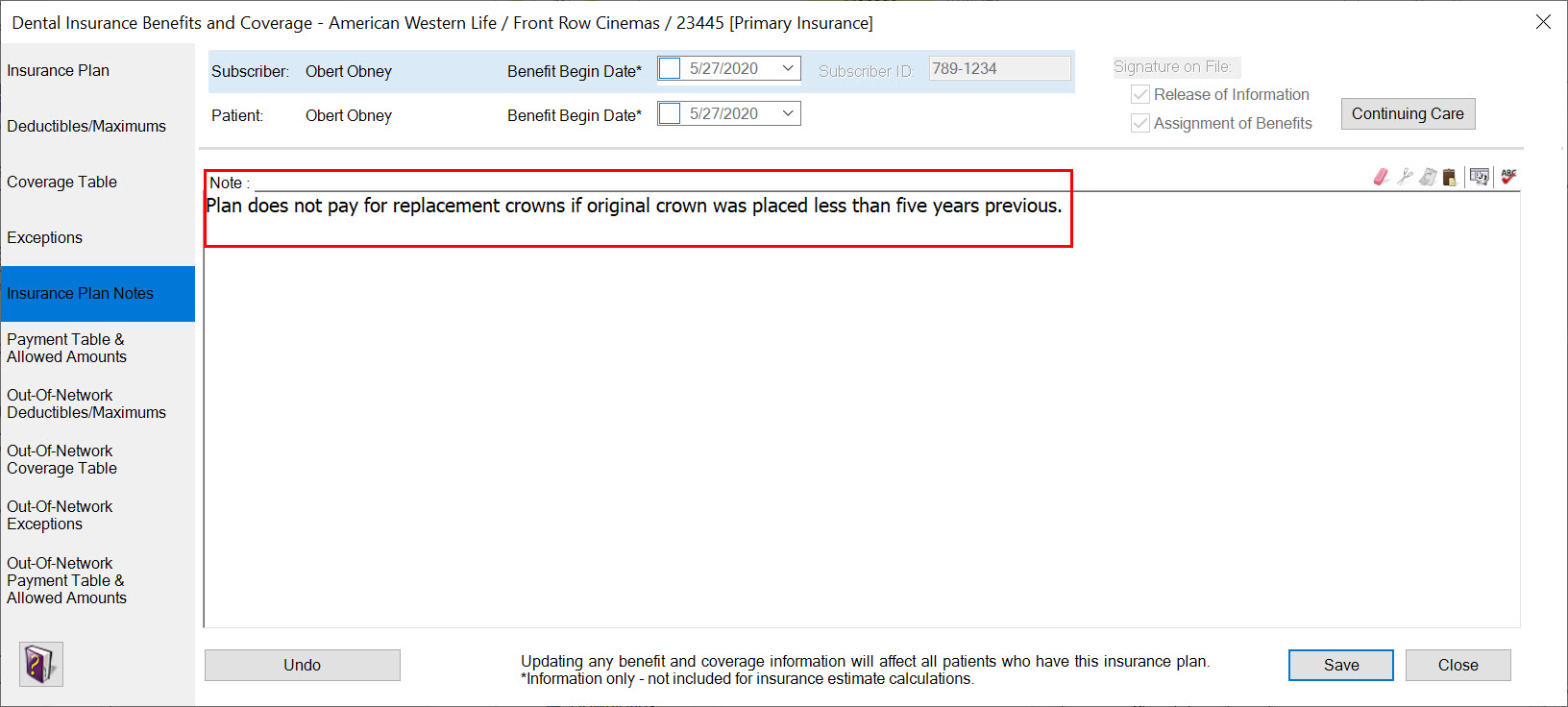

You can also enter any information you have from the insurance carrier about plan limitations and exclusions as Insurance Plan Notes. These should be notes that are specific to the carrier and not individual patients. These notes will display for all patients covered by the plan, and won’t print on insurance claims. Click the Insurance Plan Notes tab and enter the information.

Similarly, it’s important for your office to keep up with how much of a patient’s maximum benefits they have used to avoid an unexpected balance. Now is the time of year when many patients have met their insurance plan maximum. Dentrix tracks how much an insurance plan has paid for a patient in your office, but what about insurance payments to another office?

For example, a patient could have used some (or all) of their benefits at a specialist office, or they could be a new patient to your office, but have previously used some of their dental insurance maximum at a previous dentist.

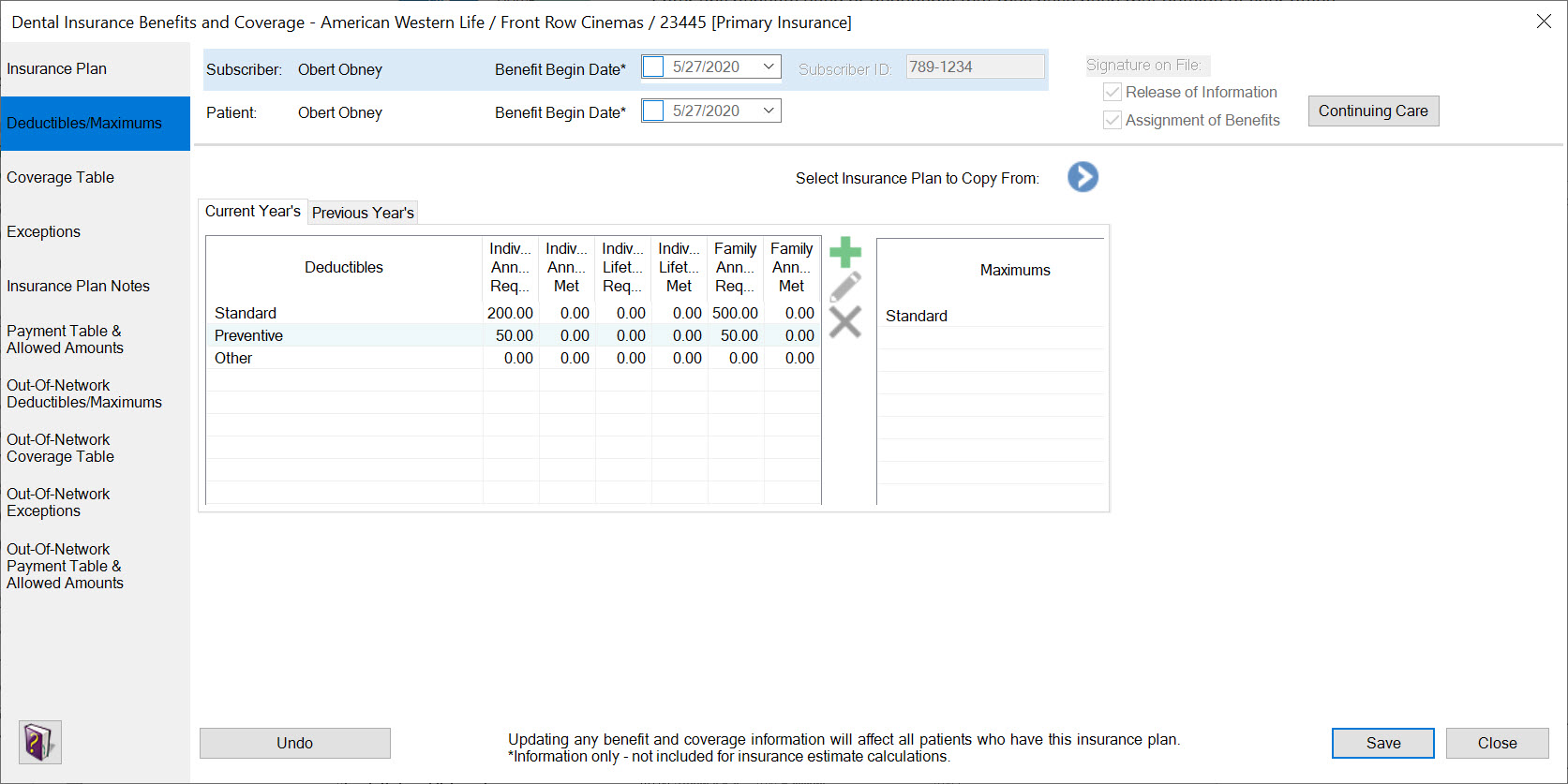

In the Dental Insurance Benefits and Coverage window, click the Deductibles/Maximums tab.

Enter any benefits used or deductible that may have been met outside of your office.

I find that keeping the deductibles met and benefits used for a patient updated is especially helpful in a case where you have referred a patient for a root canal. I know the patient will have used most of their insurance benefits at the endodontist office for this procedure. It’s important for that to be reflected when I print the patient’s treatment plan for a crown and build up on the tooth. By going in to the patient’s Dental Insurance Benefits and Coverage window and adding this information, Dentrix will calculate the correct estimated patient portion for the crown procedure, because it will take into account the insurance benefits that have already been used, and there won’t be any unpleasant surprises for me or the patient.

I find this time of year, it tends to be especially important to track how much a patient has used of their dental insurance maximum. You would need to contact the patient’s insurance company to find out how much the patient has used of their maximum outside of your office.

Learn More

For additional information, read the following :

- Improve Insurance Payment Estimates with Coverage Tables and Payment Tables

- An Easier Way to Manage Patient Insurance Details

- Some of My Favorite Recent Insurance Features in Dentrix

By Charlotte Skaggs

Certified Dentrix Trainer and The Dentrix Office Manager columnist

Charlotte Skaggs is the founder of Vector Dental Consulting LLC, a practice management firm focused on taking offices to the next level. Charlotte co-owned and managed a successful dental practice with her husband for 17 years. She has a unique approach to consulting based on the perspective of a practice owner. Charlotte has been using Dentrix for almost 20 years and is a certified Dentrix trainer. Contact Charlotte at [email protected].